Some news + MMT and endogenous money

I know I haven’t posted in a long while, but I thought I’d give some news. And no it’s not an April fools’!

Work and personal matters have taken much of my time and left me unable to allocate time to blogging so my only ‘efforts’ have been on Twitter.

MMT revived the econ scene recently, which has led to my old endogenous money posts resurfacing. The Cato Institute finance and monetary blog Alt-M recently republished one and linked to others.

I also thought this post was the right time to show some practical evidence that banks do require funding to lend. As a comment on my old post on Alt-M says, a bank branch employee does not have to deal with funding requirements before lending. This would be a practical nightmare given the number of clients that deposit, withdraw and borrow small amounts. And indeed, retail banks’ funding is managed on a macro/aggregate level from the head office.

Things are however quite different in the case of corporate banks, as much larger amounts are involved. A typical example would be an RCF (i.e. revolving credit facility), which allows a large corporation to withdraw ‘on demand’ any amount it requires within the limits set by its loan agreement.

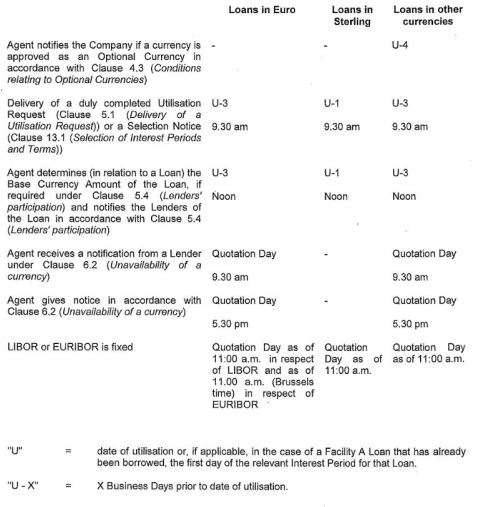

Most, if not all, revolvers comprise a timetable in their appendix that specifies how long before drawing on the facility the borrower needs to warn the treasury and operations department of the bank (or the agent in the case of a syndicate of banks) through a ‘utilisation request’. This is needed to allow the treasury to make sure they can fund the drawdown and prevent the bank running out of liquidity. And this is a direct real life counter-example to endogenous money theory.

See a publicly available example here. The utilisation request form is on page 154 and the timetable (reproduced below) is on page 172. Note how any drawdown requires the borrower to send an utilisation request one to three days before the effective drawdown. Any drawdown request occurring later than this deadline can be legally refused by the bank’s operation and treasury teams as they might not be able to secure, and then deliver, the funds.

Again, this is something that corporate bankers know, and that a number of academics seem to ignore.

____

In other news, Reuters report that the EU “approved new rules to lower capital requirements for insurers’ investments in corporate equity and debt” in order to “facilitate investment in small and medium-sized companies and provide long-term funding to the EU economy”.

This is again another example of policymakers demonstrating their clear understanding that banks (and insurers) capital requirements significantly affect the investment choice that they make. They definitely cannot pretend any longer that Basel rules had no effect on the mortgage boom of the past three decades…

____

That’s it for today. I’m not sure when I’ll be able to blog again. Could be next week, could be in six month time. I’d really like to blog more however, believe me.

you’re right of course at the individual bank level

although endogenous money is an obvious fact at the macro or banking system level

MMT ironically tends to be sloppy with accounting and operations concepts that require precision for truth

and the elephant in the room is that bank capital management is far more complicated AND important than bank reserve management, and MMT knows very little about this subject

I’m not sure what you mean by “endogenous money is an obvious fact at the macro level.”

My position has always been that fractional reserve banking necessarily implies endogenous inside money within the constraints set by the markets’ view of an adequate liquidity position (itself constrained by the availability of reserves, which are themselves exogenously-created). Beyond optimal level, endogenous expansion of broad money can occur in the short-run but is followed by endogenous contraction as the process necessarily creates some illiquid banks within the system that need to contract. Feel free to refer to my other posts on the subject.

endogenous money is just accounting at the system level

its a fancy term for a fact

“And indeed, retail banks’ funding is managed on a macro/aggregate level from the head office.”

But doesn’t this just buttress your main point? Retail banks are managing their balance sheets all the time.

At an old temp job for a midwestern (US) retail bank, I would frequently have to mail or fax property insurance documents to new lenders because mortgages were being sold/swapped around like hot cakes.