Basel 3, or 4, or 57, always the same problem

Basel standards have been amended with Basel 3, though the issue of risk-weighted assets (RWAs) remain. I have pointed out how economically distortive RWAs were, and I consider them to be a major factor that led to the financial crisis. Banks’s flexibility in estimating the capital they needed against certain assets was partially restored with the implementation of Basel 2’s IRB (‘Internal Rating-Based’), although those risk-weights were still validated by regulators to make sure they stuck to ‘acceptable’ standards (according to them). This resulted in Basel 1’s economic distortions remaining, if not sometimes amplified as bankers, expecting to boost RoE, were incentivised to overstate the quality of certain assets that regulators viewed favourably.

Now regulators are trying to manipulate RWAs further by implementing floors and removing their (half) reliance on credit ratings, what a number of people have already called Basel 4 (not an official name however). According to a member of the American Bankers Association reported by Euromoney:

“As Basel III was an admission that Basel II got things wrong, Basel IV is a clear recognition that there is much that is wrong with Basel III,” he says. “Yet the folks at Basel have not yet looked in the mirror and asked whether what is mostly wrong might be happening in Basel, that the simple concept of Basel I, to have some basic global capital standards, has been lost in an effort to over-engineer and micromanage at the global level the fine details of capital standards.”

Most people seem to understand the limitations of metrics-based RWAs:

BCBS wants to end the practice of risk-weighting lenders’ exposures by reference to external credit ratings and instead suggests using measures such as capital adequacy and asset-quality metrics on exposures to other banks, for example. For corporates, the BCBS argues a given borrower’s revenue and leverage should determine credit risk weights rather than ratings, with the latter typically discriminating between industries and local-accounting standards.

Bankers see plenty of problems. Since this way of risk-weighting exposure to other banks is determined by common tangible equity ratios and the non-performing assets ratio, it does not adequately take into account divergent liquidity and business-risk profiles, nor differences in supervisory processes under Pillar 2 of the Basel regime, says a senior regulatory adviser to the CEO of a large European universal bank.

The adviser adds: “Credit rating agencies look at a multitude of factors and these metrics are always richer, incorporating thorough timely reviews, and engagement with counterparties and agencies. You can also never empirically replace these qualitative assessments.”

I cannot agree more. I have seen a number of ‘models’ that attempted to estimate firms’ riskiness based on a few metrics. They are not accurate and sometimes way off. Qualitative assessment remains key. According to Euromoney, this new Basel methodology could largely amplify the RWA gap:

For example, the risk-weighting attached to corporates will jump from 30%-150% to 60%-300%. Meanwhile, the proposed risk weights for mortgages is in the 25%-100% range, compared with a flat 35% currently, based on the loan-to-value (LTV) ratio and a borrower’s indebtedness.

This won’t help correct the economic distortions that Basel has introduced. Quite the opposite. While Basel policymakers are right that there are problems with RWAs, the way they hope to correct them is far off the mark.

Moreover, I have only recently found out that Basel 3’s leverage ratio, which was supposed to correct some of those distortions by getting rid of RWAs altogether, actually introduces……a new RWA-type capital calculation framework, called ‘Credit Conversion Factors’. It effectively applies a ‘weight’ on certain type of off-balance sheet exposures in order to calculate the leverage ratio. It becomes obvious that, consequently, banks are going to be incentivised to leave aside banking products that suffer from a high CCF and pile into those that benefit from a low CCF. It is possible that CCFs end up not being as distortive as RWAs given their focus on banking products rather than on types of counterparties.

Still, Basel seems to be repeating the same mistakes over and over again. Applying any sort of ‘weighing’ system to micromanage the financial system can only lead to disaster through the economic incentives and distorted price of credit that it creates. How many iterations of Basel standards will it take to figure it out is anyone’s guess.

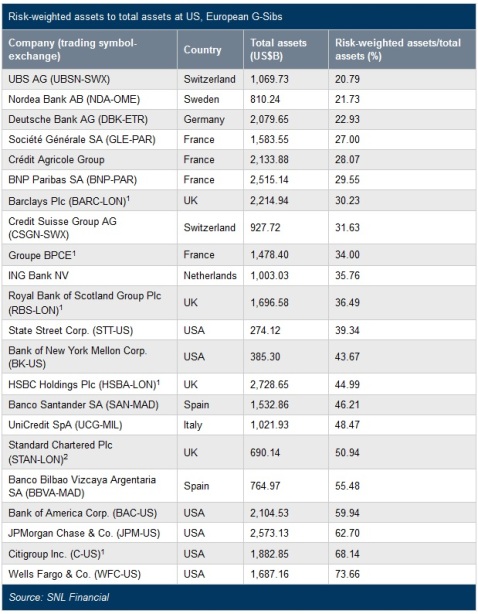

PS: Some of you might be surprised by this table compiled by Euromoney/SNL, which clearly shows that European banks use ridiculously low average risk-weights on their assets compared to their American peers:

Well, keep in mind that accounting standards are different. US GAAP allows for a lot more derivatives to be netted than IFRS (used by European firms). Consequently, many European banks end up with derivatives accounting for more than 35/40% of their total assets, whereas American peers’ derivatives only account for a few percent of their balance sheet, making them look much less leveraged.

Trackbacks / Pingbacks