Mises’ Theory of Money and Credit, Funding Valuation Adjustment and other stuff

Quick post today. A few interesting Austrian economics links first.

Liberty Fund is hosting an interesting debate on Ludwig von Mises’ Theory of Money and Credit. I read that book in 2012, a 100 years after it was released and for its 101 years, Lawrence White is writing an interesting review of what he thinks was original and/or revolutionary in this work. Liberty Fund also asked a few other economists to comment on White’s article and on Mises’ book: Jörg Guido Hülsmann, Jeffrey Rogers Hummel, and George Selgin. They reply to each other so the debate is constantly evolving, which is cool.

The Bastiat blog of the Mises Institute advertised the Austrians in Finance LinkedIn group. Good opportunity to network with fellow Austrians working in financial services. I actually didn’t know that group before, so I just joined!

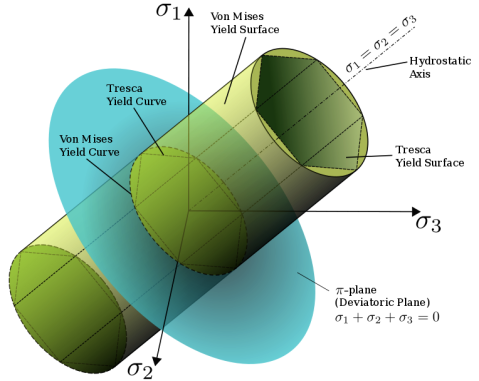

Bob Murphy had a funny post a few days ago about… the von Mises yield curve! Sounds financial, which would be logical given Mises’ work, but it is actually about material physics… And the theory’s author wasn’t Ludwig von Mises but Richard von Mises. They were contemporaries and the theory was formulated in 1913, just one year after The Theory of Money and Credit was published!

Finally, nothing to do with Mises or Austrian economics, but here is an interesting link for the (possibly very) few of you who analyse banks and would be interested in finding out more about Funding Value Adjustment (FVA). FVA is the new fashionable accounting tool used by some investments bank to help value their derivatives portfolio. JP Morgan reported a… USD1.5bn loss after implementing FVA last week, making people wonder where all those new acronyms came from and how they could lead to such losses out of nowhere. Deutsche Bank also reported a EUR623m charge related to FVA, as well as DVA and CVA (debt and credit valuation adjustments, now ‘famous’, unlike their ‘new’ little brother).

Diagram: Wikipedia

Recent Comments