Wicksell is hiding; the real estate boom isn’t

The Wicksellian natural rate of interest remains an economic mystery. No one knows what its level is. That wouldn’t be a problem if no one tried to emulate (or voluntarily tried to manipulate it downward or upward), that is, if we had a free market for money. But we don’t and a number of central banks attempt to estimate what this interest rate is so they can play with their own monetary policy tools.

Problem is, no one has a proper definition, and we often hear about a ‘neutral’ rate of interest, or a ‘natural’ rate that would maintain CPI stable or on a stable growth trend, and/or a rate that would be consistent with ‘full employment’ or that would allow GDP growth in line with an often ill-defined ‘potential output’. This is all very confusing, and doesn’t seem to accurately represent what Wicksell originally called the ‘natural rate of interest’, that is, the rate whose level would not affect ‘commodity prices’ and is similar to the rate of interest of a money free world (see Interest and Prices). Some believe the natural rate to be relatively stable; others believe it to fluctuate in line with business cycles. This Bruegel post sums up quite well the differing views that a number of current economists hold.

A common view today is that the natural rate has turned negative in most of the Western world since the financial crisis. It’s a view held by a wide range of economists, from Keynesians to Market Monetarists. Scott Sumner believes that the rate is firmly negative (David Beckworth too, and he denies that central banks affect interest rates – see also my response to Ben Southwood on the same topic) because

Since 2008, the inflation rate has usually been below the Fed’s 2% target, and if you add in employment (part of their dual mandate) they’ve consistently fallen short. This means that money has been too tight, i.e. the actual interest rate has clearly been above the Wicksellian equilibrium rate.

He is therefore surprised by a new piece of research by two Richmond Fed economists, who came up with very different conclusions.

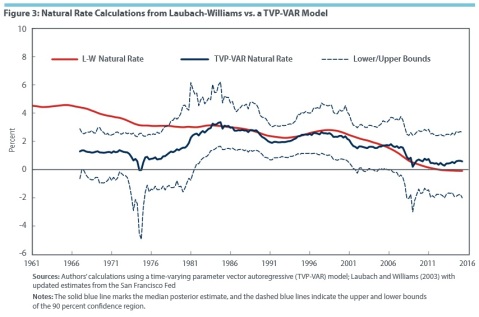

First, they remind us of an estimate of the natural rate made by Laubach and Williams, which shows the nominal rate to have fallen into negative territory since the crisis, but also that the real rate is too loose:

Using a different methodology, which they believe more accurately reflects Wicksell’s original vision, the authors estimate the natural rate of interest to be higher than that estimated by LW. They also point out that it never turns negative.

This demonstrates how tricky it can be to estimate this rate (see their lower/upper bound estimates…), and how easily central bankers could make policy mistakes as a result. (See also estimates from Thomas Aubrey’s methodology, i.e. ‘Wicksellian differential’)

Interestingly, all Fed economists above estimate the natural rate to be below the real money rate of interest from around 1994 to 2002, that is, money was too tight during the period. Thomas Aubrey, by contrast, finds the opposite result, with a positive Wicksellian differential over the period, meaning that money was too loose. Similarly, Anthony Evans writes on Kaleidic Economics that his own estimate of the UK natural rate is 2.3%; much higher than the current BoE rate.

If the Fed economists are right, it means that the classic Austrian Business Cycle theory (i.e. malinvestments originating in economic discoordination due to money rate of interest below the natural rate) cannot apply to most of the two decades preceding the crisis (it can in the case of Aubrey’s theory however).

As some readers already know, malinvestments and economic discoordination can still happen independently of the level of the risk-free natural rate of interest. This is what I theorised in my RWA-based ABCT: Basel banking regulations add another layer of distortion to the credit allocation process.

Where it gets scary is that, according to the same Fed economists, the current monetary policy stance is too loose. I find it hard to understand the outright dismissal of those estimates by a number of economic commentators and professors. Some commenters on Sumner’s post don’t even try to discuss the theoretical basis of this Richmond Fed paper. They see some sort of conspiracy or whatever. Not really the highest sort of intellectual debate to say the least. When some ‘evidence’ seems to challenge your theoretical framework, don’t dismiss it outright. Address it.

Personally, I have repeated a number of times that I find it hard to believe that our recent economic woes were so severe that they led to a market clearing, natural, Wicksellian rate below zero for the first time in the history of mankind. I have also tried to show elsewhere that a free banking system would be highly unlikely to drop rates below the zero-lower bound.

Now, if the estimates highlighted above are right, I fear possibly huge distortions in the real estate market. Let’s define a simplified free-market mortgage interest rate as

MR = RFR + IP + CRP – C,

where MR is the mortgage rate, RFR is the applicable, same maturity, risk-free rate, IP the expected inflation premium, CRP the credit risk premium that applies to that particular customer and C the protection provided by the collateral (that is, house value, with lower LTV loans leading to higher C).

Ceteris paribus, if the RFR is pushed downward, MR goes down, likely stimulating the demand for real estate credit. But this can also apply to all sort of lending. Enter Basel.

In a Basel world, the favourable capital treatment of such loans increases the supply of loanable funds towards the real estate sector. MR is pushed down even further, leading to an increase in demand for mortgages, in turn pushing house prices up, which raises the value of collateral C, which lowers MR further. It’s a virtuous (or rather vicious) circle. On the other hand, the stimulating effect of the lower RFR applied to SME lending gets ‘suppressed’ by the reduced supply of loanable funds for that type of credit. (and there are many other impacts on the RFR emanating from Basel)

I warned more than two years ago that this situation would continue. And this is precisely what has been happening. While the media complain on a weekly basis that SMEs are starved of bank credit and turn to alternative lenders (while regulators attempt to revive the market for securitised corporate loans), the Economist reports that housing markets are either strongly recovering or even way overvalued in most advanced economies. This sort of continuous and rapid house prices booms and busts was unknown in history before the 80s/90s (see also here).

It is unclear what the exact contribution of low risk-free rates is, relative to Basel’s. What is certain is that, if Richmond Fed economists are right, we’re in for another housing disaster as Basel’s effects get amplified by monetary policy (which doesn’t necessarily imply that the effects would be similar to those of the 2008/9 crisis, although historical evidence shows that housing bubble are the most damaging types of ‘bubbles’).

8 responses to “Wicksell is hiding; the real estate boom isn’t”

Trackbacks / Pingbacks

- - 27 October, 2015

- - 5 November, 2015

- - 30 May, 2016

- - 23 June, 2016

I’m a french economic consultant. First of all I want to congratulate you for Spontaneous Finance articles and “actuality follow-up” ! I’ve got a Phd in economics and I’m an austrian free-market thinker !

I do not know if I’m right but as time preference is an individual data and as each of us has a different time preference I think that natural rate of interrest is inderectly linked to savings. For example if savings are 20% of actual revenu natural rate is nearly 5% and the more the savings are abundant the lower is the interest rate. Today as there is a big mixture of guenuine savings and artificial credit we should distinguished these two sources of Credit to determine the natural rate and obviously we should only take into account guenuine savings. And if we take this remark into account actual interest rates are far more too low because for example if the China rate of savings is 40% natural interest rate for china should be 2,5% and as I do not know if there are chinese bonds I cannot verify my hypothesis !

So if you want you can call me to discuss about it !

Again thank you for Spontaneous Finance.

Pascal, thank you for your comment.

You are absolutely right that the propensity to save has a crucial role in determining the natural rate (through the loanable funds model).

You are also absolutely right that money creation by authorities distort this rate by ‘simulating’ saving (what Austrians called ‘forced savings’).

However, don’t forget that the natural rate is determined both by the supply for loanable funds (ie savings), but also by the demand for loanable funds (demand for credit for example). As a result, we cannot predict the natural rate based on saving rates only. China has a high saving rates but also a very high investment rate, so its natural rate may not be that low in the end!

Happy to discuss whenever you want!

I’m trying to wrap my head around the idea of people having negative time preference and…I can’t.

The “the Fed has been tight for years” view doesn’t seem credible to me. Virtually all Market Monetarists will tell you they believe aggregate demand is important in the short run, not the long run. But it seems like they’ve been lengthening the short run every year for coming on eight years now. (Not universally so, but still). At some point the short run’s gotta end.

As far as definitions of the Natural Rate go, I think Hayek went down a blind alley by trying to reason from barter. The only definition which makes sense is that which would equate the desired level of voluntary savings to investment. This differs from Wicksell’s definition also insofar as stability of commodity prices may be inconsistent with that norm, which will essentially always be the case if there is real supply side growth.

I agree. Negative time preference doesn’t make much sense to me.

Are we in such desperate economic times?

I’m not sure Wicksell meant that commodity prices should be stable. I think he meant that commodity prices should not be impacted by nominal effects alone (ie meaning that rates are at their natural level).

In such circumstances, only real effects can change commodity prices. If real effects are unchanged and prices do fluctuate, then monetary policy isn’t ‘neutral’.