Banks’ risk-weighted assets as a source of malinvestments, booms and busts

Here I’m going to argue that Basel-defined risk-weighted assets, a key component of banking regulation, may be partly responsible for recent business cycles.

Readers might have already noticed my aversion to risk-weighted assets (RWAs), which I view as abominations for various reasons. They are defined by Basel accords and used in regulatory capital ratios. Basel I (published in 1988 and enforced from 1992) had fixed weights by asset class. For example, corporate loans and mortgages would be weighted respectively 100% and 50%, whereas OECD sovereign debt would be weighted 0%. If a bank had USD100bn of total assets, applying risk-weights could, depending on the lending mix of the bank, lead to total RWAs of anything between USD20bn to USD90bn. Regulators would then take the capital of the bank as defined by Basel (‘Tier 1’ capital, total capital…) and calculate the regulatory capital ratio of the bank: Tier 1 capital/RWAs. Basel regulation required this ratio to be above 4%.

Basel II (published in 2004 and progressively implemented afterwards) introduced some flexibility: the ‘Standardised method’ was similar to Basel I’s fixed weights with more granularity (due to the reliance on external credit ratings), while the various ‘Internal Ratings Based’ methods allowed banks to calculate their own risk-weight based on their internal risk management models (‘certified’ by regulators…).

This system is perverse. Banks are profit-maximising institutions that answer to their shareholders. Shareholders on the other hand have a minimal threshold under which they would not invest in a company: the cost of capital, or required return on capital. As a result, return on equity (ROE) has to at least cover the cost of capital. If it doesn’t, economic losses ensue and investors would have been better off investing in lower yielding but lower risk assets in the first place. But Basel accords basically dictate banks how much capital they need to hold. Therefore banks have an incentive in trying to ‘manage’ capital in order to boost ROE. Under Basel, this means pilling in some particular asset classes.

Let’s make very rough calculations to illustrate the point under a Basel II Standardised approach: a pure commercial bank (i.e. no trading activity) has a choice between lending to SMEs (option 1) or to individuals purchasing homes (option 2). The bank has EUR1bn in Tier 1 capital available and wishes to maximise returns while keeping to the minimum of 4% Tier 1 ratio. We also assume that external funding (deposits, wholesale…) is available and that the marginal increase in interest expense is always lower than the marginal increase in interest income.

- Option 1: Given the 100% risk-weight on SME lending, the bank could lend EUR25bn (25bn x 100% x 4% = 1bn), at an interest rate of 7% (say), equalling EUR1.75bn in interest income.

- Option 2: Mortgage lending, at a 35% risk-weight, allows the same bank to lend a total of EUR71.4bn (71.4bn x 35% x 4% = 1bn) for EUR1bn in capital, at an interest rate of 3% (say), equalling EUR2.14bn in interest income.

The bank is clearly incentivised to invest its funding base in mortgages to maximise returns. In practice, large banks that are under the IRB method can push mortgage risk-weights to as low as barely above 10%, and corporate risk-weights to below 50%. As a result, banks are involuntarily pushed by regulators to game RWAs. The lower RWAs, the lower capital the bank needs, the higher its ROE and the happier the regulators. Banks call this ‘capital optimisation’.

Consequently, does it come as a surprise that low-risk weighted asset classes were exactly the ones experiencing bubbles in pre-crisis years? Oh sorry, you don’t know which asset classes were lowly rated… Here they are: real estate, securitisation, OECD sovereign debt. Yep, that’s right. Regulatory incentives that create crises. And the new Basel III regime does pretty much nothing to change the incentivised economic distortions introduced by its predecessors.

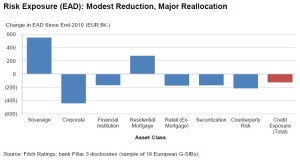

Yesterday, Fitch, the rating agency, published a study of lending and RWAs among Europe’s largest banks (press release is available here, full report here but requires free subscription). And, what a surprise, corporate lending is going…down, while mortgage lending and credit exposures to sovereigns are going…up (see charts below). The trend is even exacerbated as banks are under pressure from regulators to boost regulatory capitalisation and from shareholders to improve ROE. And this study only covers IRB banks. My guess is that the situation is even more extreme for Standardised method banks that cannot lower their RWAs.

The ‘funny’ thing is: not a single regulator or central banker seems to get it. As a result, we keep seeing ill-founded central banks schemes aiming at giving SME lending a boost, like the Funding for Lending Scheme launched by the Bank of England in 2012, which provided banks with cheap funding. Yes, you guessed it: SME lending continued its downward trend and the scheme provided mortgage lending a boost.

Should the situation ‘only’ prevent corporates to borrow funds, bad economic consequences would follow but remain limited. Economic growth would suffer but no particular crisis would ensue. The problem is: Basel and RWAs force a massive misallocation of capital towards a few asset classes, resulting in bubbles and large economic crises when the crash occurs.

The Mises and Hayek Austrian business cycle theory emphasises the distortion in the structure of relative prices that emanates from central banks lowering the nominal interest rate below the natural rate of interest as represented by economic agents’ intertemporal preferences, resulting in monetary disequilibrium (excess supply of money). The consequent increase in money supply flows in the economy through one (or a few) entry points, increasing the demand in those sectors, pushing up their prices and artificially (and unsustainably) increasing their return on investment.

I argue here that due to Basel’s RWAs distortions, central banks could even be excluded from the picture altogether: banks are naturally incentivised to channel funds towards particular sectors at the expense of others. Correspondingly, the supply of loanable funds increases above equilibrium in the favoured sectors (hence lowering the nominal interest rate and bringing about an unsustainable boom) but reduces in the disfavoured ones. There can be no aggregate overinvestment during the process, but bad investments (i.e. malinvestments) are undertaken: the investment mix changes as a result of an incentivised flow of lending, rather than as a result of economic agents’ present and future demand. Eventually, the mismatch between expected demand and actual demand appears, malinvestments are revealed, losses materialise and the economy crashes. Central banks inflation worsen the process through the mechanism described by the Austrians.

I am not sure that regulators had in mind a process to facilitate boom and bust cycles when they designed Basel rules. The result is quite ‘ironic’ though: regulations developed to enhance the stability of the financial sector end up being one of the very sources of its instability.

RWA-based ABCT Series:

- Banks’ risk-weighted assets as a source of malinvestments, booms and busts

- Banks’ RWAs as a source of malinvestments – Update

- Banks’ RWAs as a source of malinvestments – A graphical experiment

- Banks’ RWAs as a source of malinvestments – Some recent empirical evidence

- A new regulatory-driven housing bubble?

31 responses to “Banks’ risk-weighted assets as a source of malinvestments, booms and busts”

Trackbacks / Pingbacks

- - 8 November, 2013

- - 25 November, 2013

- - 27 November, 2013

- - 3 December, 2013

- - 14 January, 2014

- - 22 January, 2014

- - 9 April, 2014

- - 27 April, 2014

- - 6 May, 2014

- - 30 May, 2014

- - 11 June, 2014

- - 28 August, 2014

- - 23 September, 2014

- - 21 November, 2014

- - 20 February, 2015

- - 17 March, 2015

- - 13 May, 2015

- - 7 July, 2015

- - 25 July, 2015

- - 1 September, 2015

- - 20 October, 2015

- - 9 February, 2016

- - 9 March, 2016

- - 14 March, 2016

- - 26 March, 2016

- - 23 June, 2016

- - 11 July, 2016

- - 8 January, 2018

- - 21 September, 2021

I suppose what I am having trouble dealing with is why would investors/banks be willing to allocate funds to sectors of the economy that were being artificially inflated?

Often in macroeconomic models, one assumes there is perfect information and this is used to form expectations – this is clearly not the case, so I guess the challenge here is the regulations in fact pervert already imperfect information away from what might be a ore accurate assessment of reality.

But then you have to explain why. What is it about regulation that makes people become stupider?

I don’t think it’s a question of becoming ‘stupider’.

I do think this is a question of acting on imperfect, or false, information though.

Remember that, before the crisis, the basic assumption/expectation of most banks, analysts, and people in general, was that house prices would only go up. In their ‘mental rational model’, risk was very low: prices just couldn’t collapse. They rationally acted on the basis of this information and reasonning.

(this shows that we can give ‘rational expectations’ any sense we want…)

Some people were also willing to profit from the market movement by speculating, amplifying the price increase, hoping to sell before the market collapses. This is perfectly rational as well.

There are also many evidences that show that many banks were aware of what was happening, but just couldn’t stop playing the game as the rules were fixed. The most risk-averse ones often underperformed (in terms of profits, share price, pre-crisis) the banks that collapse during the crisis…

If you were a contrarian, everything was against you: regulation and profitability.

There is no surprise that Citigroup’s CEO, Prince, declared that:

“As long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

They knew the risk. But that had little choice.